Inflation in real estate prices is what gives consumers confidence to buy real estate and know that it will be worth more tomorrow than it is today. It could be argued that inflation is good for homeowners and good for agents because as homes become more expensive the average commission paid on a listing or sale transaction rises accordingly.

If inflation is good for homeowners and good for agents, then who suffers? The answer is simple. It’s broker owners.

Here’s the problem. Around 20 years ago, as an industry, we started to cap the amount of money that agents paid to the broker. Most commission plans start at a lower amount and then accelerate to a higher amount. “What’s your cap” replaced “what’s your commission” as the most asked question in a recruiting meeting. This capping system limits the amount of company dollar that brokers collect – no matter how high real estate prices go. To make matters worse, during the boom years of 2019, 2020 and 2021 the conversation was more about reducing caps not increasing them. So, what impact does this have on the broker owner?

Let’s look at a simple business model.

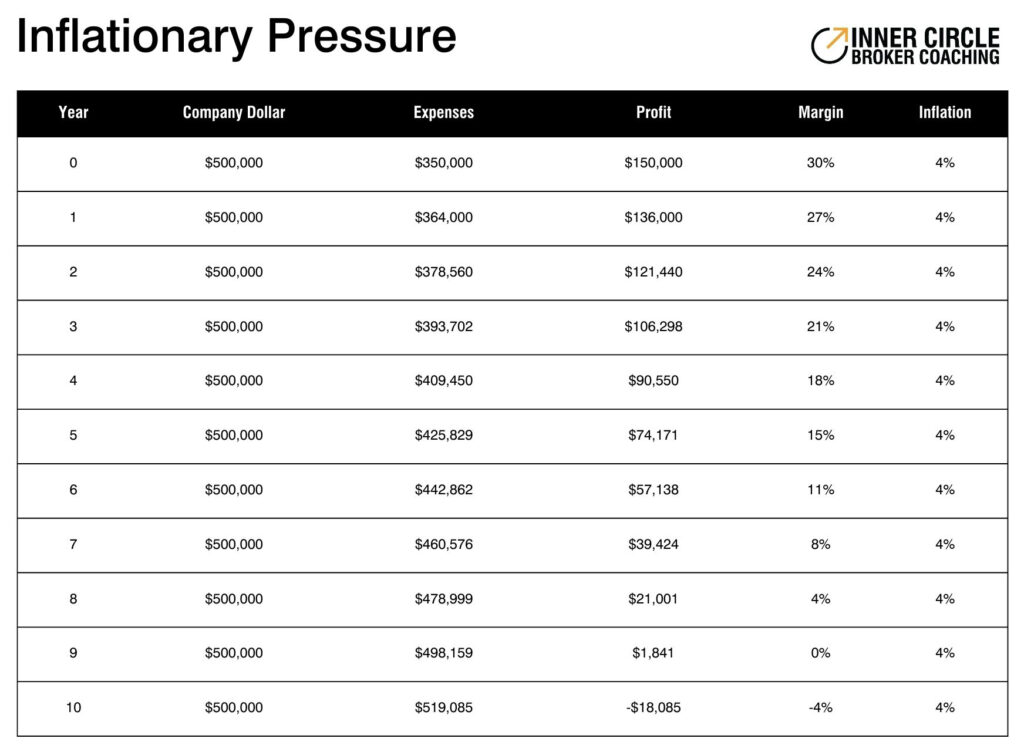

Let’s say we have a brokerage that returns a net profit a 30% of the company dollar. In other words, if they collect $500,000 from all sources, $150,000 or 30% falls directly to the bottom line and becomes profit. Now let’s assume this company operates in an environment where inflation averages 4%. If you think about it, over the last 15 years inflation has ranged from 2% to 6% averaging 4%.

Let’s also assume that the broker in our case study has a capped commission model that caps after they collect $10,000 from each agent. They have 50 agents and therefore collect $500,000 in company dollar. The costs in our case study are $350,000 and the profit is $150,000. The 4% inflation rate applies only to the costs increasing them every year. Remember our commission program is capped and we are not increasing the cap to keep pace with inflation. After only five years our costs have increased to 425,000, splitting our profit in half. After 10 years at only 4% inflation our cost has crept up to $518,085 and we are now losing money. Inflation has taken our business which was returning a best practice profit and turned it into a money loser.

As the inflation impacts the costs, the revenue does not rise because it’s capped. Sure, we can recruit more agents and add and ancillary services, but those extra efforts now go to subsidizing the increased cost and not to increase profitability. This simple example is how many brokers find themselves asking, “why can’t I make money anymore”. They simply have not raised their prices to keep pace with inflationary pressures. These stark facts become even more obvious when the market declines in transaction count as it has over the past year.

So, what’s the solution?

- Have a look at your model. Understand what your target percentage profit margin is. This is essential to understanding how much money you have left over to invest in expenses. As an example, if you would like to have a 30% profit margin, you have 70% of your company dollar left to invest in expenses.

- Allocate your expenses (the 70%) to each area of the business required to operate and grow leaving enough leftover to drive your target profit margin.

- Calculate how much you need to collect on average from each agent to make this model work.

- Ensure that your value proposition supports the amount of money you need to collect from each agent. We call this your uniqueness in the market place.

I’ve helped hundreds of brokers take unprofitable companies and make profitable ones by doing simple analysis and executing our price increase strategy. Often, I have been able to do this with little or no agent loss and we have 100% success at the turnaround. In other words, if we lose agents, the business is always significantly more profitable than when we began.

If you’re not profitable today or you don’t have a plan to address the insidious and ongoing impacts of inflation on your brokerage business, make sure you access our free tools or attend one of our free events.

The modern real estate brokerage model is more profitable than ever before. Successful brokers are making more money today than at any time in this industry. It’s time you structured your business to return the kind of rewards that you and your family deserve.